The real estate market in Valencia remains popular among both Spanish and international buyers. In the fourth quarter of 2024, we once again see this region as one of the fastest-growing areas in Spain. Discover the latest figures, trends, and forecasts for 2025 for the region, province, and city of Valencia in the Analysis Real Estate Market Valencia 2024 Q4.

General situation real estate market Spain in 2024 Q4

In the third quarter of 2024, the average price in Spain of both new and existing homes rose 3.1% on last year and 1.3% on the previous quarter. This represents a slight increase that keeps prices close to inflation levels.

Demand for houses in Spain remains strong. Between January and July, the number of house sales and purchases increased by 8% compared to the same period last year, according to data from notaries. The number of sales is being boosted by easier access to mortgages now that the European Central Bank has stopped raising interest rates.

On the other hand, the supply of houses remains limited. Between January and May, the number of building permits increased by 14.8%. While this is a positive development, it is still not enough to meet demand in popular areas, where land is scarce. The combination of strong demand and limited supply means that house prices remain under pressure.

More on Spain’s Q4 2024 real estate figures can be found here.

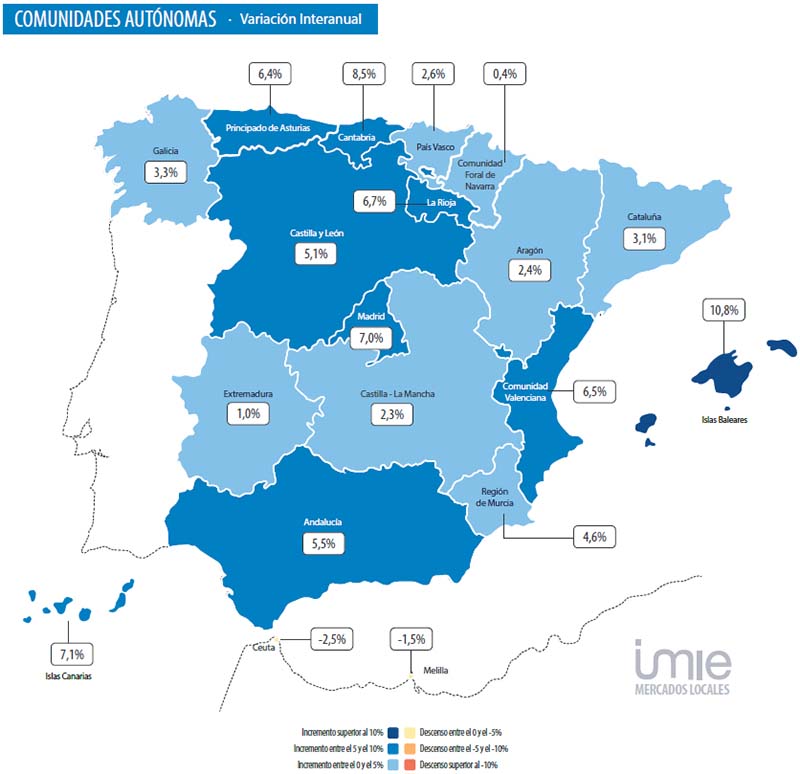

Property prices Valencia vs other regions in Spain

The Valencia region shows a stronger annual price increase than many other Spanish regions. While the national average is at an increase of 4.4%, Valencia clearly stands out at 6.5%. This increase is mainly driven by the provinces of Valencia (6.5%) and Alicante (8.5%).

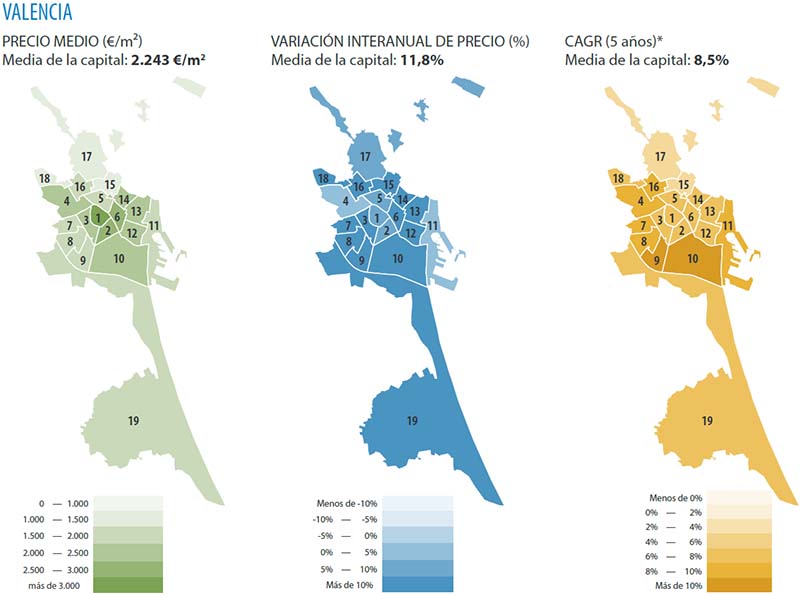

Even more striking is the increase year-on-year in Valencia city, at 11.8% one of the highest price increases in Spain. However, compared to Madrid (+7.1%) and Barcelona (+5.7%), Valencia remains a more affordable option, making it attractive to buyers looking for a combination of good investment opportunities and lower prices.

The average price per square metre is now €2,243 in Valencia city and €1,709 in the province. By comparison, the price in Madrid is €4,030/m² and in Barcelona €3,937/m². For a complete comparison, we should also contrast this with London, where you pay an average of €13,300/m² for a property (and even €27,500/m² in prime central areas), and New York City, where the average is around €12,800/m² (with prime Manhattan properties reaching €28,000/m²).

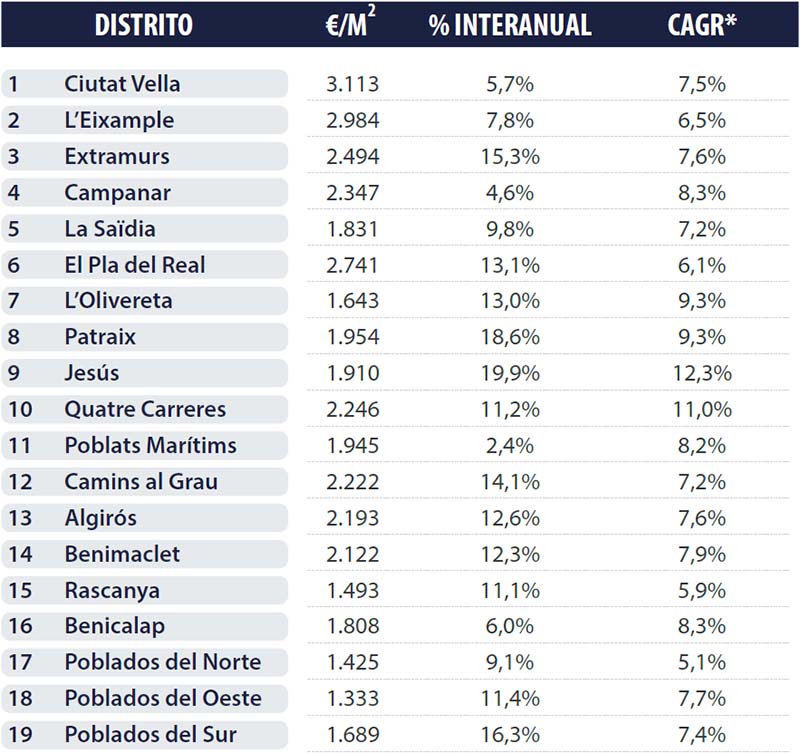

Property prices Valencia city by neighbourhood and district

Housing prices in Valencia city increased in all districts, ranging from 2.4% to 19.9%. The biggest increases were recorded in: Jesús: +19.9%, Patraix: +18.6, Poblados del Sur: +16.3% and Extramurs: 15.3%.

The most expensive neighbourhoods can be found in the districts of Ciutat Vella (the city centre) with an average price of €3,113/m², followed by L’Eixample (which includes the Ruzafa district) and El Pla del Real (surroundings of football stadium Mestalla). Other neighbourhoods such as Algirós, Benimaclet and Quatre Carreres and are also seeing strong growth with price increases of 12.6%, 12.3 and 11.2% respectively.

Return on investment in Valencia according to CAGR

To get a good idea of the return on property in Valencia, we look at the CAGR (Compound Annual Growth Rate), which shows the average annual growth rate over a given period.

With an annual average growth rate (CAGR) of 6.6% over five years, Valencia offers impressive returns. This is higher than returns in Barcelona (5.6%) and Madrid (6.0%), making the city particularly attractive to long-term investors. This return refers only to the increase in value of the property itself, excluding any rental income.

Conclusion real estate market Valencia 2024 & forecast 2025

Valencia’s property market is growing solidly. Prices are rising faster than the national average, and the city remains popular with investors and buyers. However, limited supply is creating continued price pressure in popular neighbourhoods. Valencia province is seeing similar trends, with price increases exceeding the national average. Demand also continues to increase in less urban areas, partly due to a combination of lower prices and attractive living conditions.

In 2025, the European Central Bank is expected to cut interest rates further, making mortgages more accessible. This could lead to an increase in demand for property in both the city of Valencia and the province. Limited housing supply remains a challenge, especially in popular neighbourhoods and suburbs. As a result, prices are expected to rise further. Investments in new construction projects and strategic purchases in both urban and rural areas can therefore be very profitable in the coming years.

Do you have any questions following this analysis or are you interested in investing in Valencia? Feel free to contact us. We are ready to help you!