The entire real estate market in Spain is showing strong growth figures in 2025, but there is one market that is performing slightly better than average: Valencia. In the Analysis Real Estate Market Valencia 2025 Q3, we highlight the developments in house prices in Valencia compared to other regions of Spain, dive into the price differences per neighbourhood within the city and draw a conclusion about the market in the third quarter of 2025.

General situation real estate market Spain in 2025 Q3

Across Spain, house prices rose by an average of +11.7% year-on-year and +3.0% quarter-on-quarter in Q3 2025. Even adjusted for inflation, this represents real growth of +8.6%. This continues the accelerated upward trend.

Demand remains high, partly thanks to stable employment and lower mortgage costs due to falling interest rates. The number of transactions also grew: in the first half of 2025, 7.6% more homes were sold and the number of mortgages increased by 18.7% (notaries) to as much as +38.3% according to the INE.

The market is clearly in a healthy growth phase, with strong demand and supply struggling to keep up.

Property prices Valencia vs other regions in Spain

Valencia is one of Spain’s fastest-growing property markets. In the third quarter of 2025, house prices in the Comunidad Valenciana recorded double-digit growth, particularly in the provinces of Alicante (+15.3% year-on-year) and Valencia (+12.8%). Only a few other regions, such as the Comunidad de Madrid (+19% year-on-year) and the Balearic Islands (+14-15%), were also among the leaders. However, the average price per square metre is considerably higher in those regions.

The Valencia region also showed a significant acceleration quarter-on-quarter (>4% in Q3), placing it among the frontrunners such as Andalusia and Madrid.

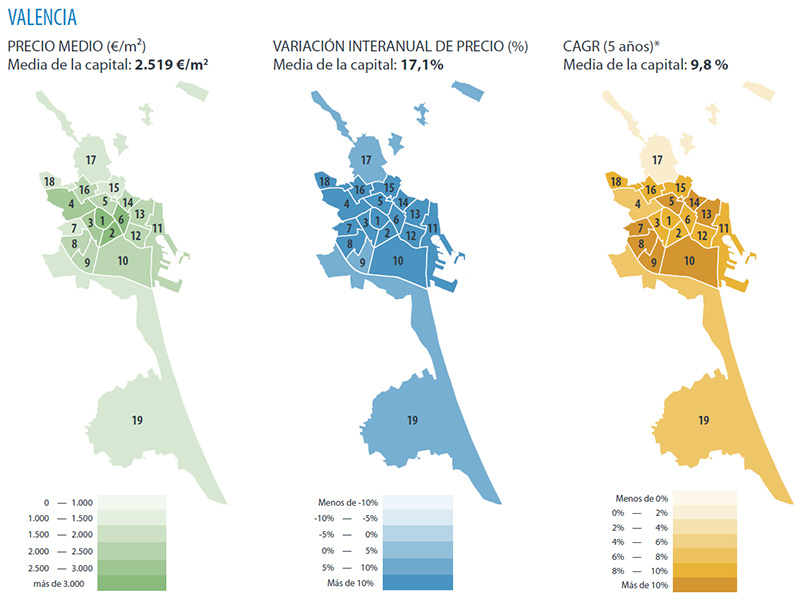

In terms of value, Valencia offers an attractive combination of affordability and growth. The average price per square metre in the city of Valencia is approximately €2,519. This is considerably lower than in top markets such as Madrid (€4,664/m²) or Barcelona (€4,156/m²), but slightly above the national average of approximately €2,018/m². In other words, Valencia is considerably cheaper than Spain’s most expensive cities, while price increases are above average. This underlines that the region offers great value for money, an attractive prospect for both home buyers and investors.

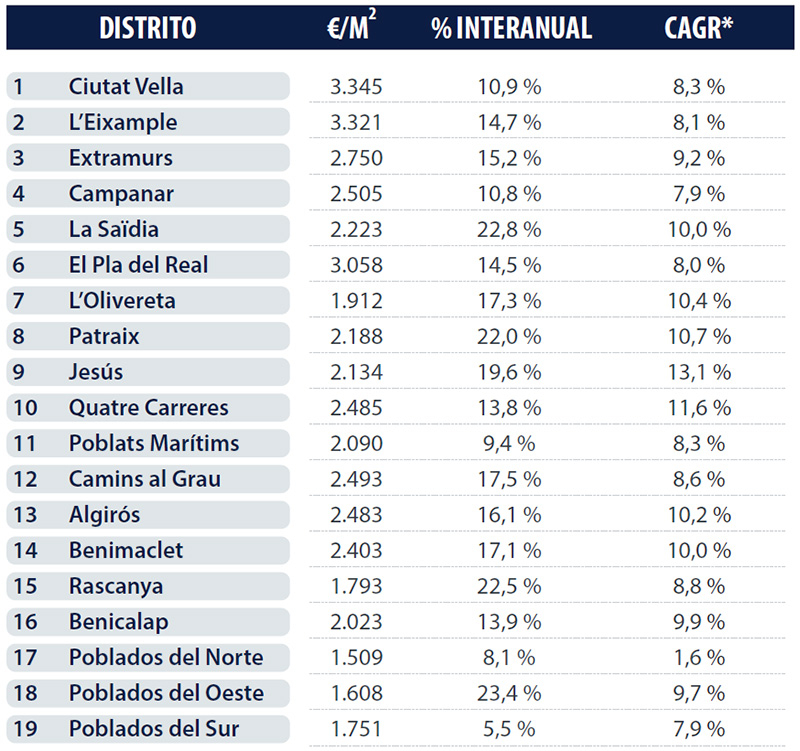

House prices in Valencia city by neighbourhood and district

Within the city of Valencia, house prices have risen in all neighbourhoods over the past year. The variation in annual price increases per district ranges from +5.5% (in Poblados del Sur, the lowest growth) to as much as +23.4%. Several neighbourhoods saw spectacular increases of over 20% on an annual basis, such as Poblados del Oeste, La Saïdia, Rascanya and Patraix. These previously more affordable neighbourhoods on the outskirts of the city are clearly attracting more and more buyers, causing prices to catch up.

However, the traditional prime locations in Valencia remain the most sought-after and therefore also the most expensive. In Ciutat Vella (the historic city centre), Eixample (Ensanche) and El Pla del Real, average prices are above €3,000 per square metre. In contrast, the lowest prices are found in the outlying areas: in districts such as Poblados del Oeste and Poblados del Norte, the average price is less than €1,700/m². The average transaction price for the city as a whole is around €2,500/m², so the differences between the centre and the outskirts are considerable. Nevertheless, the same picture applies everywhere: the trend is upwards. Even the relatively inexpensive neighbourhoods of Valencia saw sharp price increases last year, illustrating the city’s broad appeal.

Return on investment in Valencia according to CAGR

The returns on property investments in Valencia are impressive. A useful measure of this is the CAGR (Compound Annual Growth Rate), which reflects the average annual growth over a period of 5 years. According to the data, Valencia city has a CAGR of approximately 9.8%, which is an exceptionally high percentage. By way of comparison, the national average is around 5.2% per year. Valencia even outperforms other top cities in this respect; Madrid’s 5-year growth is estimated at approximately 8% per year, and Málaga’s at approximately 9.4%.

With almost 10% annual value growth, real estate in Valencia has therefore delivered an excellent return over the last 5 years. In concrete terms, anyone who bought a property in Valencia five years ago has seen its value increase by an average of almost 60% (compound growth over 5 years ≈ 9.8% per year). From a broader perspective, the province of Valencia is also among the frontrunners: together with regions such as Málaga and the Balearic Islands, Valencia has a compound 5-year growth of over 7% at the provincial level. These figures confirm that investing in Valencia has been a smart move in recent years, and market developments suggest that this positive scenario will continue.

Conclusion on the Valencia real estate market in Q3 2025

The real estate market in Valencia is in excellent shape in Q3 2025. Prices are rising sharply, both compared to the rest of Spain and within the various city districts. Demand for housing is widespread: we are seeing growth from the historic centre to the suburbs, with no significant decline in any segment. No Spanish capital experienced a price decline in the past quarter, and Valencia is no exception; on the contrary, it is among the fastest risers.

Importantly, Valencia is not only showing growth, but also reaching milestones. By 2025, the city will have surpassed its previous peak (from the 2007 bubble). House prices are now more than 4% higher than the historic high before the financial crisis. Compared to the low point after that crisis, house values have more than doubled (+108% since the trough). This powerful recovery underscores the long-term value development in Valencia.

In short, the property market in Valencia is robust and dynamic. The combination of relatively affordable prices, high growth rates and strong returns makes the city a very attractive place to live and invest. The outlook remains positive: all indicators, from price increases to rental yields, point to a healthy market that can be viewed with confidence.

Want to know more about living or investing in Valencia?

Are you curious about the possibilities of living or investing in Valencia? Please feel free to contact us for more information or advice. Our experts know the local market inside out and are happy to help you get started.

Source: TINSA